Financial Wellness vs. Financial Literacy

Did you know that January is Financial Wellness month? SEIA Senior Partner Tom West offers definitions of financial wellness and financial literacy and discusses the unique needs of individuals with assets like retirement accounts, homeownership, and brokerage accounts.

What is Financial Wellness?

SEIA Senior Partner Tom West explains, “financial wellness involves feeling secure about your financial future, giving you choices about how, when, and with whom you spend your time. Financial wellness also improves your mental and physical well-being while reducing your preoccupation with the job of the money.”

Financial wellness requires you to take intentional and mindful steps towards achieving financial well-being that serves families holistically. Practically speaking, financial wellness involves having adequate income and savings levels, a plan to cover risks like long-term care, and understanding how social and emotional factors affect one’s view on finances. The opposite of financial wellness is financial stress.

The Consumer Financial Protection Bureau (CFPB) defines financial wellness as: “A state of being wherein you have control over day-to-day, month-to-month finances; have the capacity to absorb a financial shock; are on track to meet your financial goals, and have the financial freedom to make the choices that allow you to enjoy life.” The CFB offers a short financial well-being questionnaire to determine your financial wellness score and compare yourself to others by age, household income, and employment status.

How does Financial Wellness differ from Financial Literacy?

Financial literacy, the knowledge of financial concepts and skills, is one component of financial wellness. Financial literacy means someone is educated about personal finance and knows what to do in different financial situations. However, financial literacy doesn’t guarantee that someone will actually take appropriate action when decisions need to be made.

For example, at age 72, you must start taking required minimum distributions (RMDs) from your retirement account(s) such as IRAs, SEPs, SIMPLEs, 401(K)s, and 403(b). And if you don’t take your RMD, you could incur a 50% penalty of the RMD amount. Different rules apply for personally owned retirement plans and those inherited from a non-spouse. However, for charitably inclined older adults, a Qualified Charitable Distribution (QCD) is another way to potentially satisfy the RMD by gifting to a charity up to $100K of an otherwise taxable distribution. This knowledge – or financial literacy – alone doesn’t bring financial wellness, but taking action on the RMD or QCD could bring you to a state of financial well-being.

Financial wellness is deeply personal because your goals and dreams are specific to you and change over time. Financial wellness needs to be looked at and assessed regularly, like physical and mental health. Especially since significant life changes like the death of a loved one, grey divorce, diagnosis of a chronic illness, or moving to a retirement community come in your 60s, 70s, and 80s. While the skills and knowledge of financial literacy will aid you during your lifespan, the holistic nature of financial wellness is crucial to improving your healthspan (years of healthy living).

Is Wealth an Indicator of Financial Wellness?

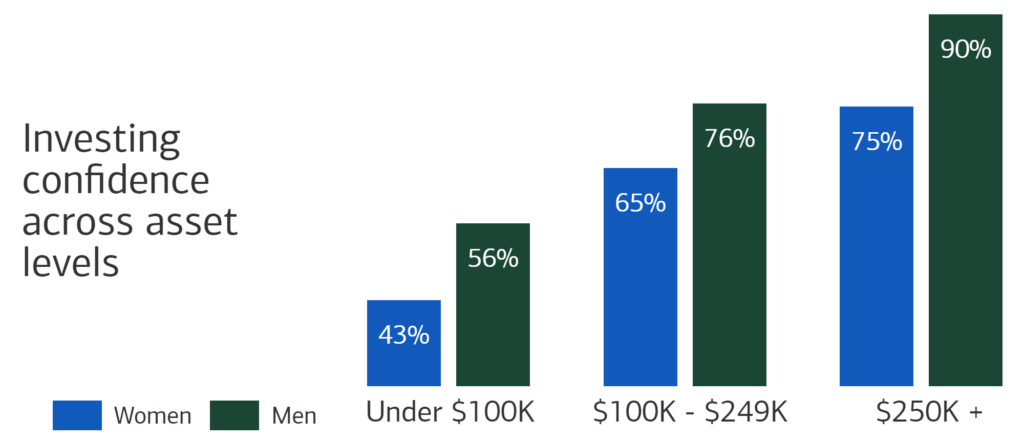

The National Financial Educators Council (NFEC) defines financial wellness as “possessing the skills and knowledge on financial matters to confidently take effective action that best fulfills an individual’s personal, family, and global community goals.” The NFEC definition doesn’t mention how much a person needs in savings because financial wellness isn’t about wealth. With that said, we believe that the ability to make decisions and execute on them is, in and of itself, a significant determinant in psychological and financial well-being. According to Merrill Lynch and Age Wave, one aspect of financial wellness, confidence in investing, increases as asset levels increase (see chart below).

Image source: https://www.ml.com/women-financial-wellness-age-wave.html

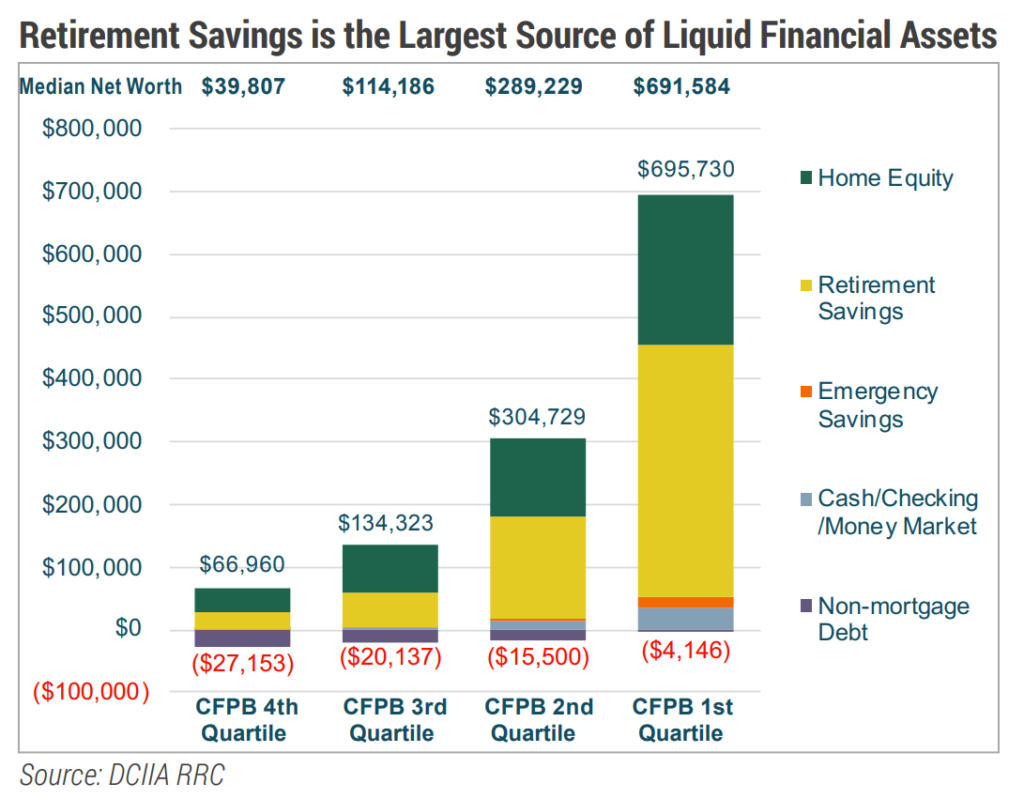

Image source: https://cdn.ymaws.com/dciia.org/resource/resmgr/resource_library/DCIIA-RRC-FinancialWellnessF.pdf

For many people, the two most significant sources of financial assets are retirement savings and home equity (see chart above). According to Saunderson House research, the definition of financial wellness for people who have assets is “a sense of happiness and confidence with current finances and future financial plans, which supports broader feelings of well-being. Financial wellness incorporates a plan to address uncertainty while recognizing some things are out of their control.” Additionally, their research shows that financial well-being is “having well-being in other walks of life” such as mental, emotional, and physical.

For retired and close-to-retired individuals, planning for healthcare and long-term care needs, minimizing taxes, preserving wealth, and removing burdens for loved ones who will receive assets after their death often become elements of financial wellness. Having a dedicated team with a certified public accountant, estate attorney, senior housing and healthcare professional, and financial advisor can create strategies specific to each individual or family.

How Can We Help You Attain Financial Wellness?

Tom West’s career for 25+ years has been dedicated to working with aging clients. When he saw the gap between financial planning and a family’s ability to pay for a plan of care recommended by healthcare providers, he created the Lifecare Affordability Plan® in 2017. LCAP™ is a holistic, health-driven financial plan that includes housing and family considerations. We offer LCAP to all our clients if they have recently received a new chronic health diagnosis, are weighing a move to independent or assisted living, or need to discuss plans for their adult children who need support. We also offer LCAP as a one-time, fee-for-service for adult children, spouses, solo agers, and couples. Completing the LCAP process is one way to achieve financial wellness.