Financial Wellness for Women

Did you know that January is Financial Wellness month? We want to explore what financial wellness is for women who, on average live longer, are statistically paid less, and may take time out of careers to raise children or retire early to serve as caregivers for aging parents or spouses.

What is financial wellness?

SEIA Senior Partner Tom West explains, “financial wellness involves feeling secure about your financial future, giving you choices about how, when, and with whom you spend your time. Financial wellness also improves your mental and physical well-being while reducing your preoccupation with the job of the money.”

61% of women would rather talk about their own death than money.

Why is financial wellness essential for women?

Maddy Dychtwald, co-founder and senior vice president of Age Wave, told Business Wire: “Women’s life journeys are not only different than men’s, but they’re also different than the life journeys of our mothers and grandmothers. We have more opportunities and choices when it comes to family, education, and careers, but we’re so busy taking care of other people and other priorities, we often don’t take the time to invest in ourselves and our future financial wellness.” Source: https://fairygodboss.com/articles/women-achieve-financial-wellness-very-differently-according-to-merrill-lynch

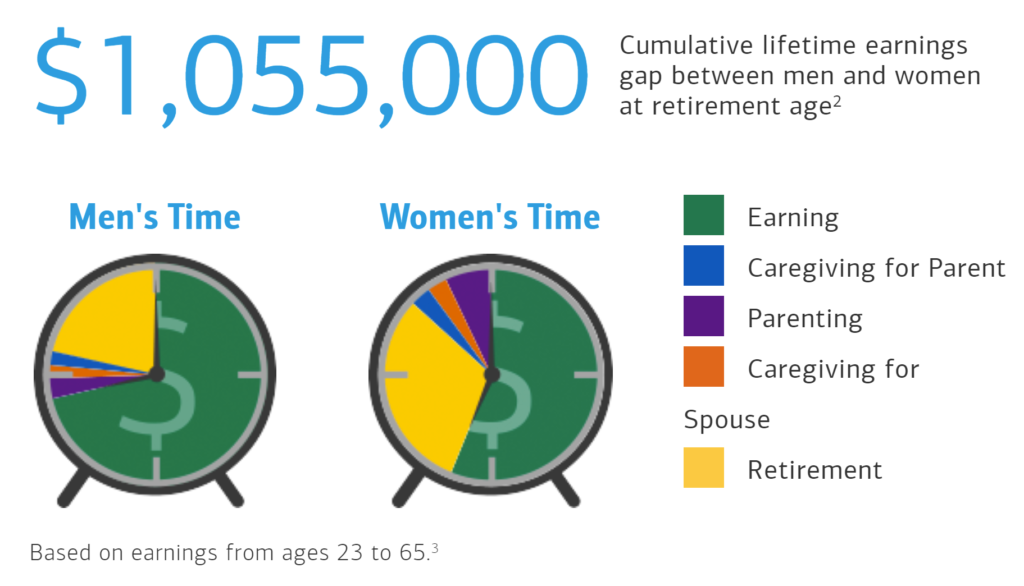

Financial wellness is essential for women because there is a cumulative lifetime earnings gap for women over their lifetimes. The difference is partly due to lower salaries, time spent out of the workforce to care for children, aging parents, or ill spouses, and misconceptions about financial wellness.

An average woman spends 44% of her adult life out of the workforce compared to 28% for a man.

Image Source: https://www.ml.com/women-financial-wellness-age-wave.html

Women also face higher lifetime health and care costs. The average woman is likely to have higher health costs than the average man in retirement, paying an additional $195,000 due to living longer, having more health problems later in age, and relying on formal long-term care in later years. Source: https://fairygodboss.com/articles/women-achieve-financial-wellness-very-differently-according-to-merrill-lynch

The American College of Financial Services studied men and women between 60-75. 35% of men and 18% of women passed a quiz on retirement income literacy. Respondents who passed were more likely to have a retirement plan, as well as a plan to cover the costs of long-term care. According to the National Association of Realtors, since the 1990s, single women outpaced single men as first-time home buyers, repeat homebuyers, living alone, owning a home, and spending half their income on housing. And spending 15-30 years paying a mortgage can make putting cash aside for emergencies and retirement savings difficult. Source: https://www.annuity.org/financial-literacy/women/

What do women know about financial wellness and how to close the gap?

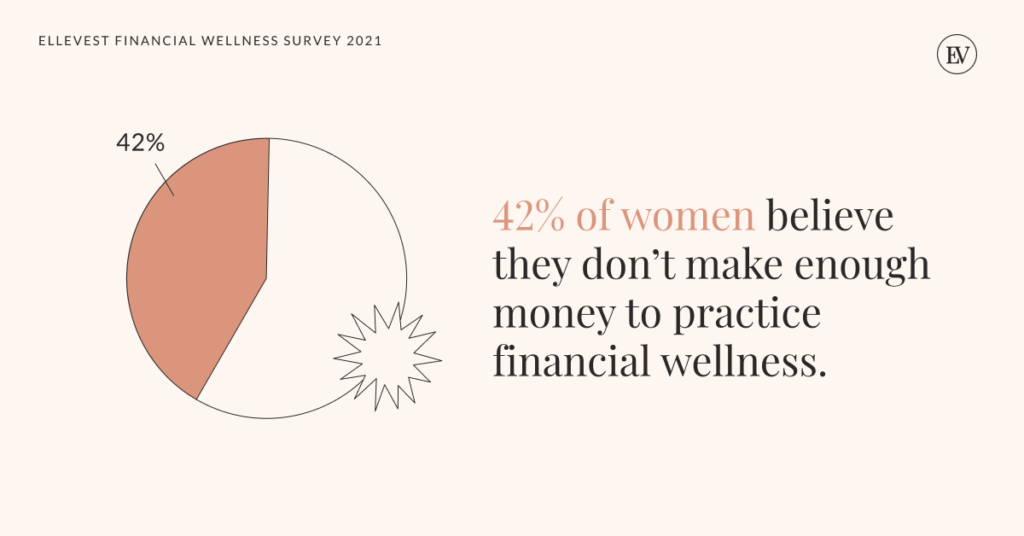

The 2021 Ellevest Financial Wellness Survey pointed out that “financial wellness is deeply undervalued compared to other forms of wellness.” The study also discovered that 21% of women never invested time in their financial well-being at all. “Only 14% of women-identifying respondents ranked financial health as the most important form of wellness.” But, 67% of women worry about their financial health at least once a week, and 36% worry daily. When asked about how they feel about money, women’s top emotion (35%) is overwhelmed.

According to Ellevest, most women have a solid understanding of financial wellness. In their survey, the majority of women define financial wellness as not being stressed (52%), feeling confident about money (51%), and having a complete understanding of their current finances (48%). Ellevest’s three-part definition of “knowing what you have, knowing where you’re headed, and feeling good about it” aligns with the survey findings.

Image Source: 2021 Ellevest Financial Wellness Survey

Image Source: https://www.ml.com/women-financial-wellness-age-wave.html

What is financial wellness for women?

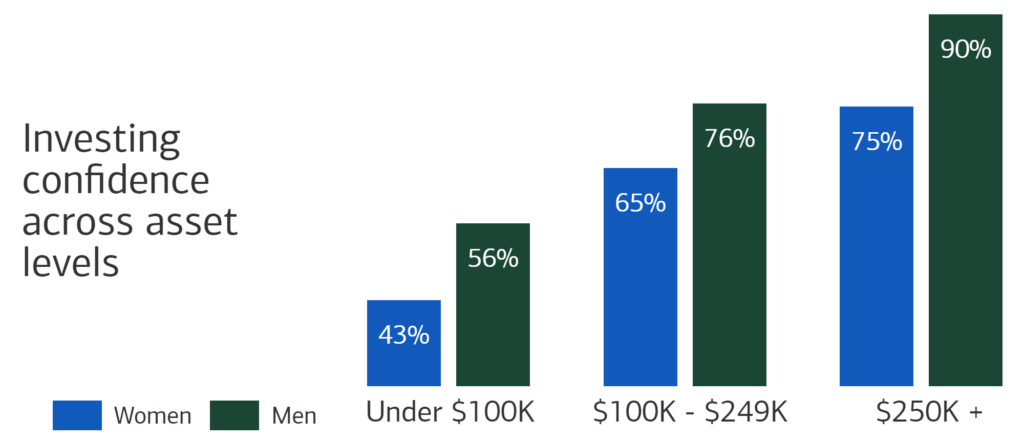

In a 2017 joint Merrill and Age Wave study of women and financial wellness, they reported, “women’s longevity, compounded by the pay and wealth gaps, makes it even more critical for women to take the necessary steps to achieving financial wellness. 41% of women regret not investing more of their money. Women are looking for financial education and solutions that align with their values and priorities, as well as their bottom line.”

According to the Merrill study, steps for women to take for financial wellness include:

- Break the taboo around money talk. Encourage conversations between friends, family, and financial professionals. Seek mentors and learn more about money and finances.

- Turn longevity into an asset. Start a retirement plan as early as you can. Work longer, if possible, to maximize Social Security and pension benefits. Take advantage of compound interest.

- Acknowledge financial challenges that impact women. Save and plan for career interruptions, longer lives to fund, and increased healthcare costs.

- Plan early and often. Consult a financial professional to discuss life priorities and goals. Create a plan that matches any unique circumstances. Revisit that plan often and make course corrections along the way.

How can we help you attain financial wellness?

We are led by Arvette Morgan Reid with 15 years of experience in independent living, assisted living, memory care, nursing homes, and hospice services, and she holds a Series 65 securities license. She teamed with SEIA Senior Partner Tom West in 2017 to create the Lifecare Affordability Plan® (LCAPTM). After working with aging clients for 25+ years, they saw the gap between financial planning and a family’s ability to pay for a plan of care recommended by healthcare providers.

LCAP is a holistic, health-driven financial plan that includes housing and family considerations. We offer LCAP to all our clients if they have recently received a new chronic-health diagnosis, are weighing a move to independent or assisted living, or need to discuss plans for their adult children with special needs. We also offer LCAP as a one-time, fee-for-service for adult children, spouses, solo agers, and couples. Completing the LCAP process is one way to achieve financial wellness.