Long-term care can be affordable, if you have a plan.

A Roadmap for an Uncertain Future

You’ve done your best to map out the future, but when a loved one faces a health crisis — the road ahead swerves, and you find yourself in unchartered territory. Adding to the emotional stress of a life-altering diagnosis are the practical stresses of planning, and paying, for long-term healthcare. Financial planning is a piece of that — but it’s just a start.

Navigating Many Influences

Changes in Health

The health of a senior with a diagnosis like dementia or ALS isn’t static – it changes. Just when you think you have decided on a course of action, a health event can happen and rewrite your future — again.

Family Dynamics

When it comes to caring for mom or dad, everyone has a role, and everyone has an opinion. It’s important that everyone is heard, but that’s not always easy.

Medical Uncertainty

Families struggling to make plans for long term care just don’t have the information they need. Medical uncertainty arises from a lack of definite information beyond diagnosis. How long will your loved one live? What kind of care will they need? This information is often impossible to medically predict, and rarely given out with certitude. It makes planning even more difficult.

Experts Everywhere

Most families have trusted advisors – friends, attorneys, financial planners and health care providers. When you begin to explore long-term care, you will also meet knowledgeable and helpful senior living professionals. All of these advisors have your best interests in mind, but may not have the expertise and experience to connect the gaps that exist between them. That’s where we come in.

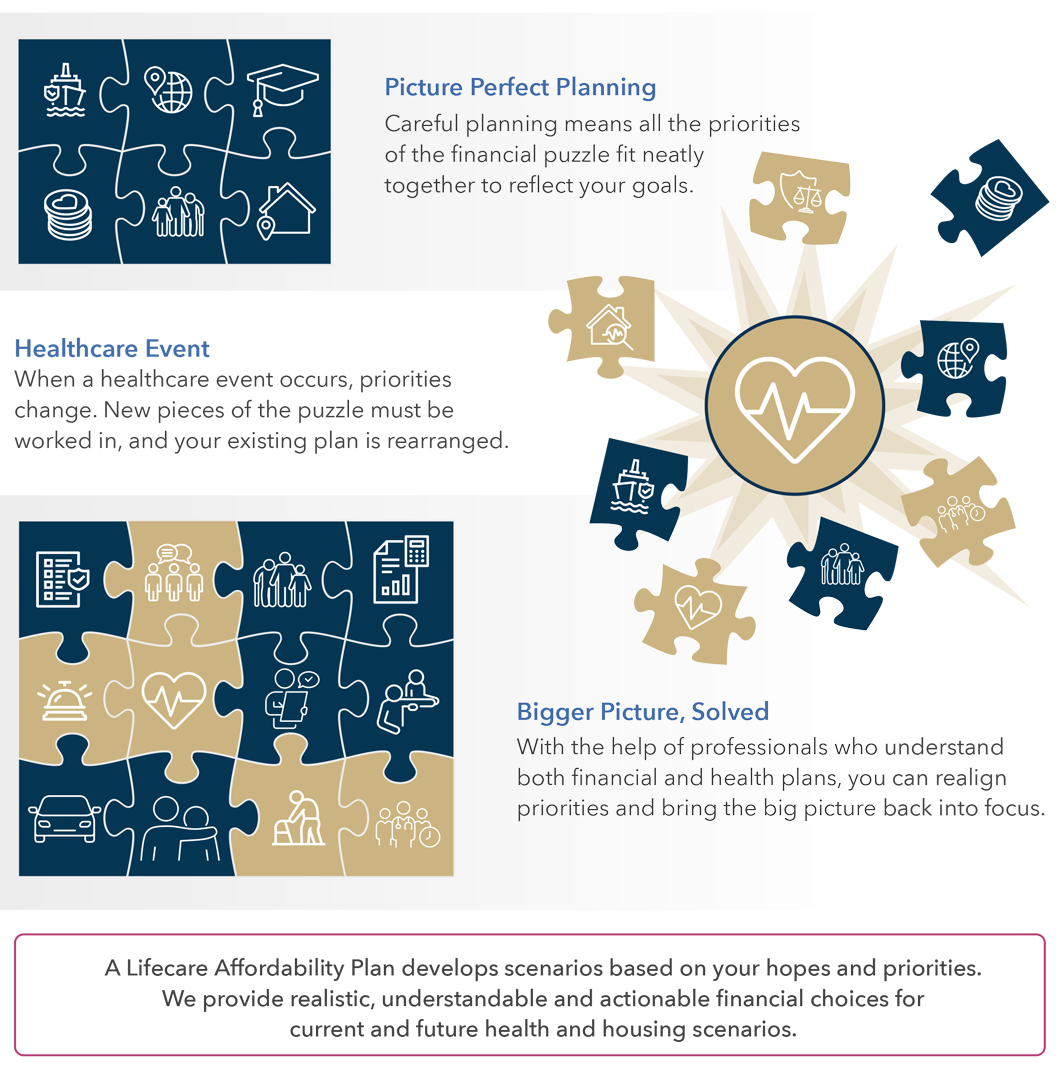

Solving the Health and Wealth Puzzle

Guides for the Journey

Our team has decades of experience working with families who have found themselves in the same difficult place where you stand now. While every family’s journey is unique — the landscape of Medicaid, care settings, legal considerations, asset protection and investing — are all well-known to us. We’ve learned how to help guide families like yours to a best-care scenario — a plan to provide the best quality care you can afford, with details customized to your loved one’s unique needs.